Aurora, Denver, LIttleton, Property Management

Why We Say NO to Rent Control

The recent introduction of bill HB23-1115 in the Colorado State House has sparked discussions about rent control and its potential impact on communities in the state. While some may see such action as a viable solution to the affordable housing crisis, it’s important to understand why it’s not the answer.

Drew Hamrick, general counsel and senior VP of government affairs of the Colorado Apartment Association, has expressed concerns about the potential negative effects of controlling rent in the state. He believes that while it may be well-intentioned, it will only make housing more expensive and less available, compounding the problem instead of solving it. This is because rent control removes the financial incentive to create new housing units and improve existing ones, and it restricts resident mobility.

One of the primary issues with rent control is that it can actually decrease the supply of available housing, driving up costs and exacerbating the affordability crisis. When property owners are limited in their ability to set rents at market rates, they may be less likely to invest in maintaining and upgrading their properties, leading to a decline in the quality of housing stock. In addition, the lack of financial incentives to build new units can reduce the supply of available housing, making it more difficult for renters to find a place to live.

Another issue with rent control is that it can negatively impact neighboring communities. If one city enacts rent control, builders may be less likely to construct new housing units in that area, driving up the cost of housing in surrounding municipalities. This can create a domino effect where renters in neighboring communities end up paying more for housing because their neighbors artificially reduced supply with the rent control ordinance.

For more than 40 years, Colorado has prohibited local governments from enacting rent control ordinances, recognizing the damage rent control can do to available housing and understanding that one local government’s housing policy can negatively impact neighboring communities. Instead of focusing on controlling rent, the state needs to implement policies that encourage the creation of more housing units.

One promising solution is to encourage the construction of multifamily units. These types of units are more energy-efficient, require less land, and are less expensive to build, making them a viable solution to the state’s housing crisis. Multifamily units also allow people to live closer to where they want to live, reducing the need to drive and improving quality of life.

In conclusion, while the affordable housing crisis is a pressing issue that needs to be addressed, rent control is not the answer. It can decrease the supply of available housing, drive up costs, and negatively impact neighboring communities. Instead, Colorado should focus on policies that encourage the creation of more housing units, particularly multifamily units, to help address the state’s housing shortage.

If you have any questions about our stance on HB23-1115, please feel free to contact us here. If you would like to voice your opposition to this bill, please follow this link.

Aurora, Denver, Property Management, Real Estate Investing

We get this question frequently: What can I expect to earn in Denver real estate income from my home rental property in the long run?

When people are considering investing in real estate, especially when considering if they should sell or rent their property, the main thing they need to be considering is cash flow. Below is the process we do, but simplified.

Selling the Denver property questions:

What is the mortgage payoff?

What will the home sell for?

What is the difference?

Renting the Denver Home property questions:

What is the appropriate amount of rent for a Colorado home?

The appropriate amount is not a number you want, but rather what the market can actually bear. A professional property manager should be able to give you this number.

What is the home mortgage amount due?

This number should include principal, interest, insurance and taxes.

What is the HOA cost? Will this number be included in the rent or not?

What other utility costs are there and will they be included in the rent?

Consider: Sewer, Water, Electricity, Gas, Snow Removal, Lawn Maintenance, Trash removal and any others that apply. This is an important number to know because they will be your responsibility if the unit isn’t occupied.

What do you need for a savings reserve? In this number, take into consideration:

- Maintenance fees. This number should be between 5-25% depending on the age of the house and its condition, including if remodeling has been done or not. Homes under 10 years old will be 5-15% and homes over 50 years of age will be closer to the 15-25% range.

- Transition savings. This number will be the expected money that will be banked for the time between tenants. A property manager can give you a good sense of your market and how much should be put aside.

- Property Management fees. These fees are worth their weight in gold. A good property management company will pay for itself in reduced legal issues, better tenants, better maintenance and more.

An example for Denver and Aurora rental home owners

Let’s take a hypothetical example. Of course, this is a simplified example for illustration only and is not advice. For professional support on your unique situation, contact us, a financial professional, and a tax professional.

John and Lisa Jones own a home and are moving out of state and are considering selling vs. renting out the property to a tenant.

Jones hypothetical selling the Colorado property questions:

- What is the mortgage payoff? $212,000

- What will the home sell for? $300,000

- What is the difference? 88,000

This is a one time chunk of money that they will pay capital gains on unless they purchase a new property. Talk to a CPA about how this works.

Jones hypothetical renting the property questions:

- What is the appropriate amount of rent? $2200/mo.

- What is the mortgage amount due? $1235/mo.

- What is the HOA cost? NONE

- What do you need for a savings reserve?

o Maintenance fees. 10%: $220/mo.

o Transition savings. 5%: $110/mo.

o Property Management fees. 12%: $264/mo.

Projected Income: $2200/mo.

Projected Expense: $1829/mo.

Difference: $371/mo.

In this scenario, the $88,000 would be returned in under 20 years, and the property will have grown in value. This also assumes the rent NEVER went up in 20 years. So at the end of thirty years the Jones would have:

A sold house that allowed them to get another house that has increased in value OR

A home they are living in that has increased in value AND a rental home that is free and clear of a mortgage payment. Their potential income then increases from $371/mo. to $1606/mo. and this can continue into retirement as a residual income.

There are additional tax benefits and consequences as a real estate investor that you should be aware of that apply in each scenario. They include what deductions are allowing whether you are living in the house or not.

This illustration is for educational purposes only and does not serve as legal or investment advice. Please contact a professional to discuss your specific situation as the numbers could be very different.

Call 720 989 1996 and let us show you how renting a home in Denver and Aurora Colorado pays!

[gravityform id=”4″ title=”true” description=”true”]

Aurora, Denver, Property Management

Legacy Properties-PM CAN get you the most rent for your investment home by careful research and comparisons of the most recent rent prices in your area. I am Devin Bewley, CEO of Legacy Properties-PM, and I use only the best software programs to help me compare rent prices around your neighborhood, and I have special access to data that the public does not.

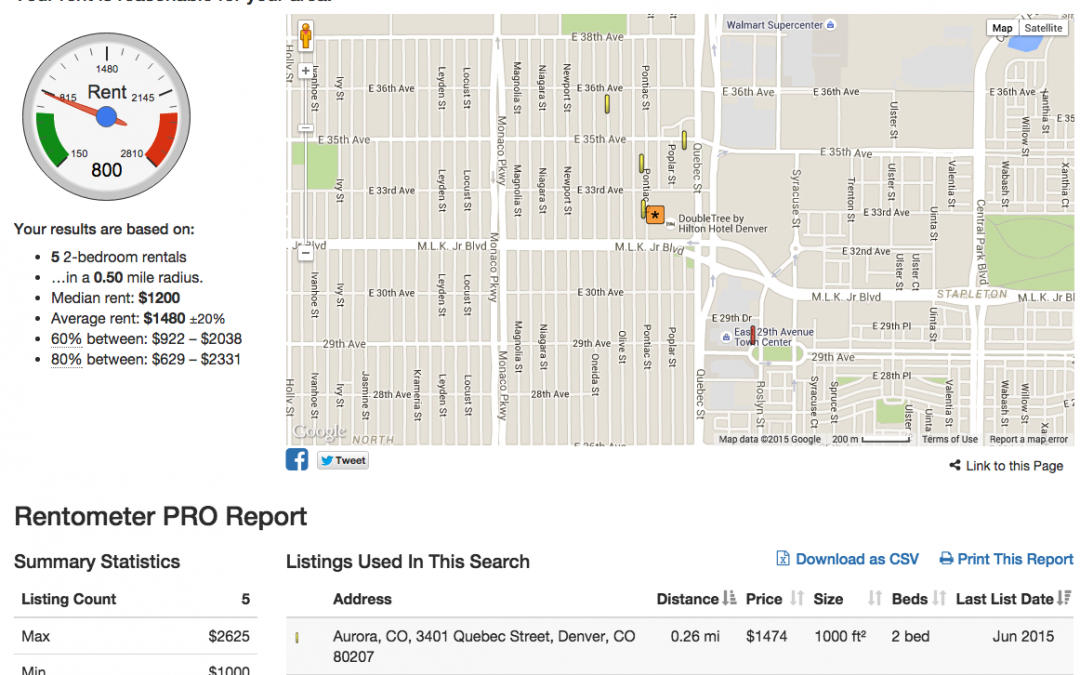

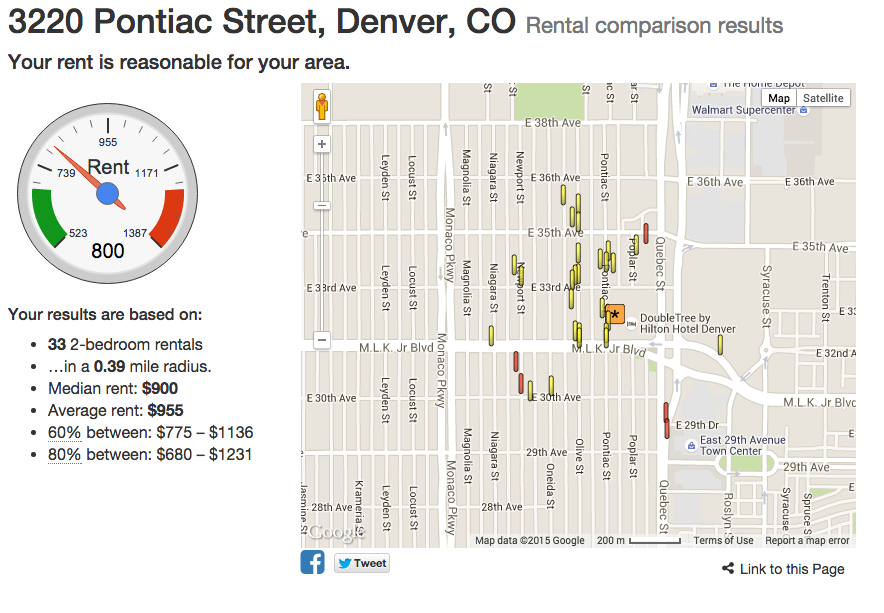

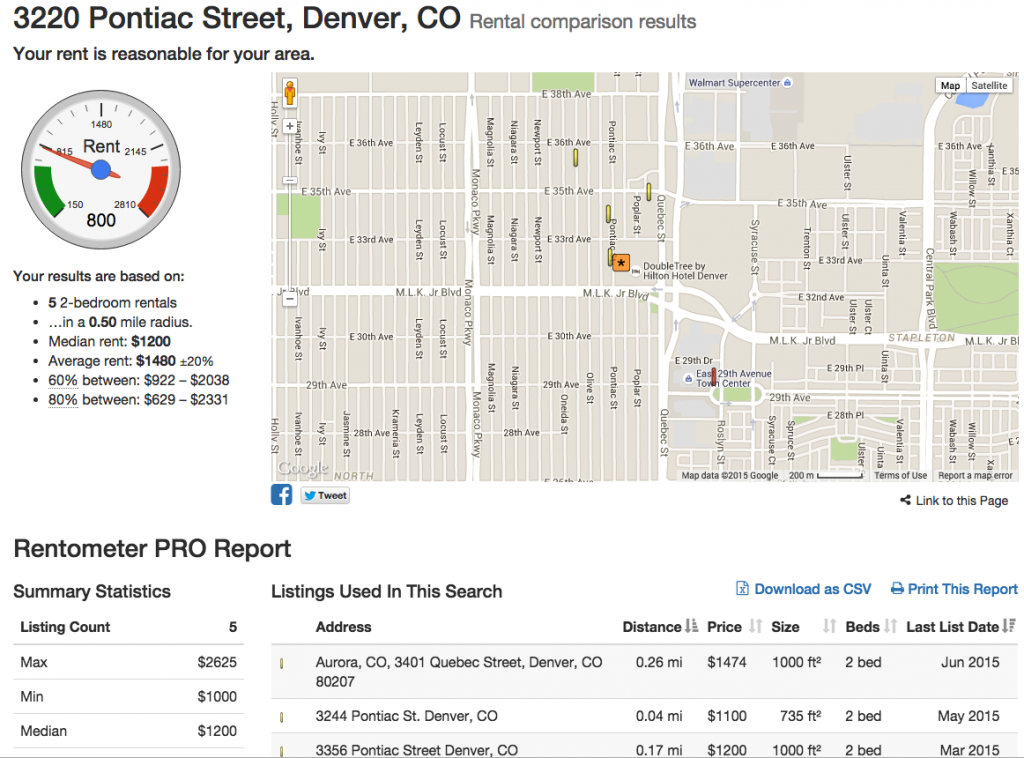

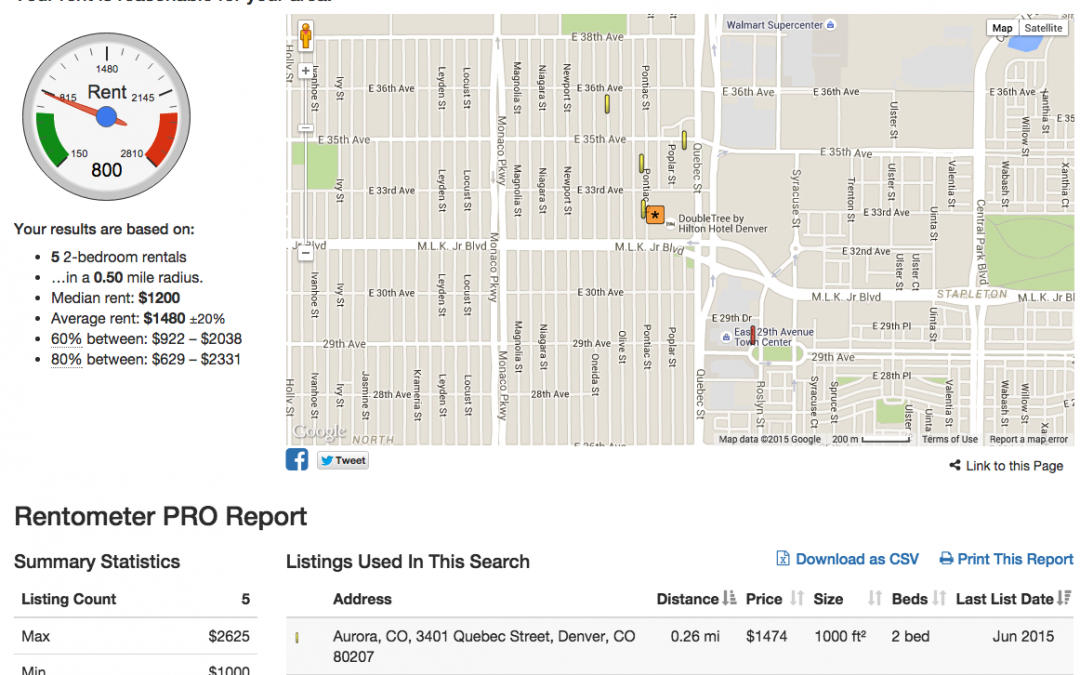

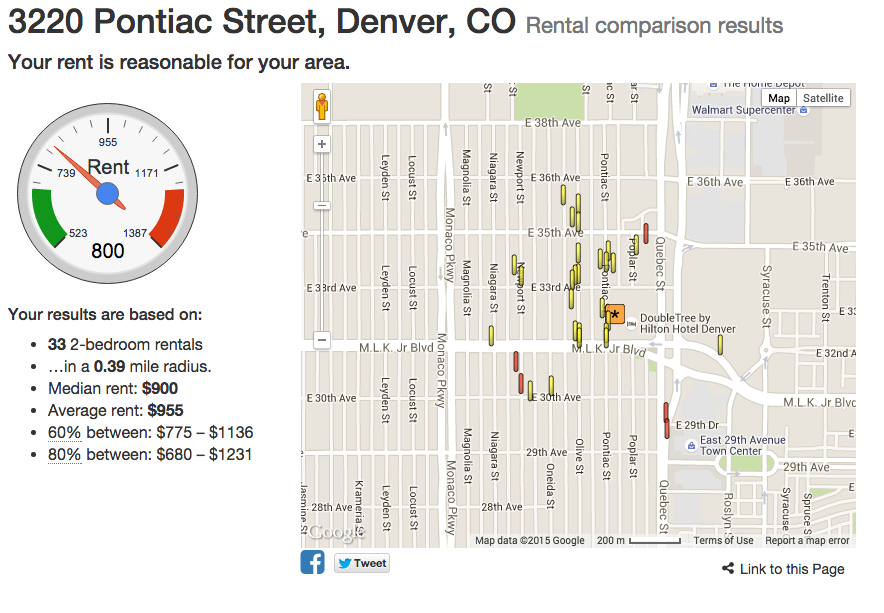

The average property management company may use a basic free program to compare rental prices in their client’s area. When looking at this comparison, the rent prices range over a year period and a much larger demographic area than is really necessary to get an accurate’ comparison. With the information below a 2 bedroom home going for $800.00 a month is considered “reasonable” in the area around the specified address. This means only a B+ grade versus the A++ grade Legacy Properties-PM gets.

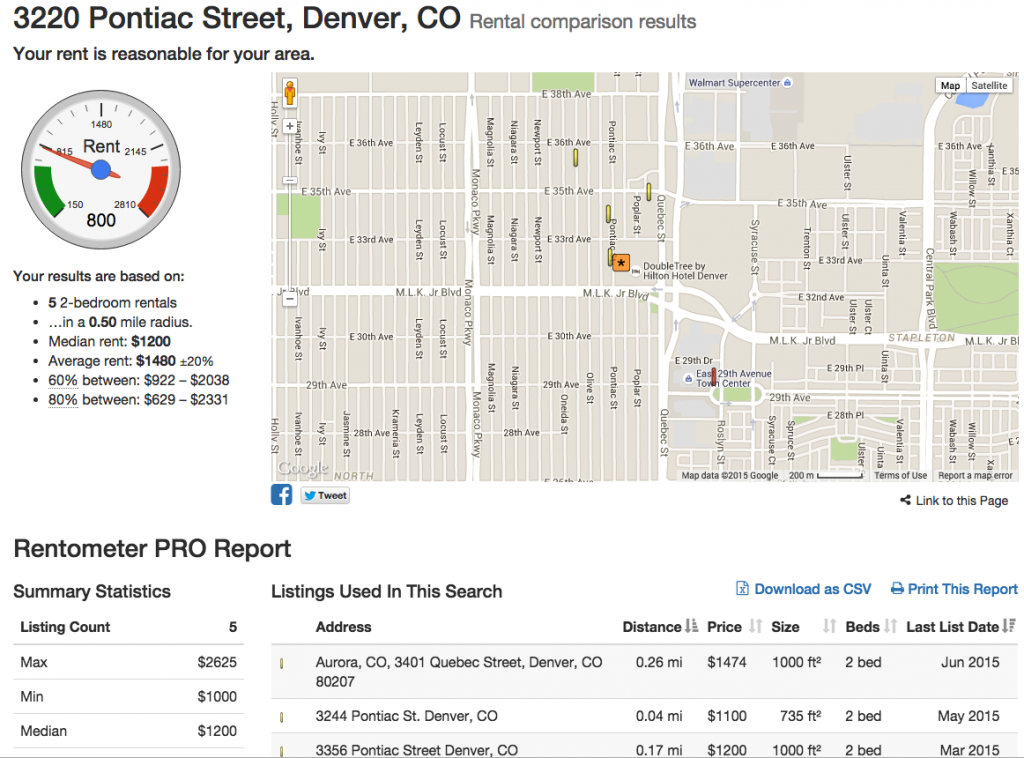

Why does our property management company deserve a superior grade when it comes to our rental comparison? Because we spend the extra time and effort to research the rent in your area much more accurately. We do this by lessening the demographic area near your rental home from 1 or more miles to a .3 mile area instead. As well as, shortening the time of recent rent rates in that area, for example comparing the last 3 months versus the last year (See below).

When we take the time and effort to get accurate rental comparisons for your Aurora or Denver rental home, you can be assured you are getting the best rent for your home. Legacy Properties-PM is here to help you with your rental investment today. Call us at 720.989.1996 or contact us.

Aurora, Denver, Property Management

Just a Few Simple Reasons Renting Can Be Better Than Buying

Reason #1: You can change your location whenever you want

Owning a home and raising a family are top priorities for some people. Settling down and finding a safe and homey suburb to live in for the next ten to twenty years is perfect for that. On the other hand, there are quite a few people who aren’t sure where they’ll be next year, let alone in a decade. This makes the idea and option of buying a home a not so feasible option.

When you rent, you have the flexibility to move next month or next year without the stress of having to find renters for your home and/or maintain a property remotely.

Reason #2: If the water heater breaks as a renter you don’t pay for it

As a renter, surrounded by homeowners you’re sure to witness the hidden costs involved in owning a home. “A friend of mine recently had to have her heater replaced and consequently ate baked beans for four months afterwards.” says renter Jackie Smith. When you rent, it’s the home owners/landlords responsibility to pay for the repairs on and in the property.

“It’s nice to not have to drop a couple of grand per year on things like curtains, hot water systems and replacing toilet cisterns,” says Jackie.

Reason #3: Renting can be less pricey than buying

People many times buy a house as a way to save money, they do this by putting most of their monies into a home and property where it can’t be touched, rather than a bank account where it’s always accessible for withdrawal. Instead of buying a home though, one can save just as well with paying rent and putting the extra money in a high returns investment bank account rather than buying property.

Whether you rent or buy, it’s important that you do what’s right for your own circumstances and your own financial situation. If you are a homeowner looking to rent out your home or a tenant looking for a new home to rent, call Legacy Properties-PM at 720.989.1996 or contact us. We proudly serve many Denver areas including Aurora, Centennial, Highlands Ranch and Parker.

Aurora, Denver, Property Management, Real Estate Investing

Should you take the plunge?

Rents continue to go up and interest rates are at an all-time low! Homeownership rates fell throughout the recession, and are currently around 66 percent, compared with almost 70 percent in 2004, according to the Census Bureau.

The great American dream of owning a home appears to have made a comeback. Real estate company Trulia reports that “in many parts of the country, rents are rising while housing prices are falling, making buying a home more affordable.”

If you’re struggling with whether to buy or rent, consider these 7 reasons to take the plunge into homeownership:

Reason 1: You can take advantage of currently low interest rates and prices.

Interest rates remain at historical lows, and at the same time, home prices in many areas remain soft. Trulia points out that deals are especially appealing in suburban areas, compared with the more expensive cities. Overall, Trulia says, asking prices on homes went down 0.7 percent over the last year, while rents went up by 5 percent.

Reason 2: Unlike rent, a fixed mortgage can’t go up (even if inflation does).

Fixed mortgage rates do not go up, even when the cost of everything else does. To protect yourself, Jack Otter, author of Worth It… Not Worth It? suggests making a 20 percent down payment and taking out a 30-year fixed mortgage to lock in today’s low interest rates. “Mortgage rates haven’t been this low since GIs were heading home from France. Lock in a low monthly payment, and you’ve just taken a huge step in protecting your family against inflation,” he writes.

Reason 3: Homeowners can take tax deductions.

The main tax benefit of homeownership is the ability to deduct your mortgage interest payments, but the bonuses don’t stop there. As a homeowner, you can also deduct eligible expenses (certain energy-efficient improvements) and in some cases can avoid federal taxes on earnings from the sale of a home.

Reason 4: No landlord can kick you out.

Renters can face an unexpected eviction notice if their landlord suddenly decides to sell the home, rent to someone else, or otherwise end the lease. Homeowners do not have to worry about this EVER.

Reason 5: You don’t even have to speak to a landlord, ever again.

Landlords can take forever to fix a broken washer or dryer, they usually let the air vents fill with dust and dirt, or they leave you messages about repairs that aren’t even necessary. BUT, if you’re the homeowner, then you’re in charge. This means you have to be home when the plumber calls or comes, but the plumber reports to you.

Reason 6: Owning a home forces you to save money and more.

Since homeowners have to pay their mortgage every month, they are routinely putting money away or paying for repairs and maintenance, instead of squandering it on new shoes or fancy meals. Then, if you eventually sell your home after the mortgage is paid off, there’s a good chance that you’ll actually make money off the sale.

Reason 7: You can customize your space.

Owning the space you live in means you have the freedom to do what you need and/or want done, without worrying about permission from the landlord or losing your security deposit. Whether you want to paint a wall, make a larger bathroom or redo the bedroom to reflect you, you CAN.

Renting can be ideal if you aren’t sure of your job circumstances or if you plan to move soon, so buying isn’t for everyone. So, if you’re looking to rent or want the best property manager to manage your rental home in Denver, Aurora, or Centennial, call Legacy Properties-PM at 720.989.1996 or contact us.

Aurora, Denver, Property Management

In Denver and Aurora, there are many very good property management companies.

The question then is, how do you decide which property management company is the best one for you?

What I tell people all the time when this comes up is that while you do need to make sure that the one you choose has the experience and training needed. But, you also need to feel a personal connection with, someone that you feel you can trust. The first part is a much easier one to answer. The most important part to finding someone who is trained and highly qualified in any field is to look for those that invest in themselves. In the case of property management, that means looking for someone who is a member of the National Association of Residential Property Managers. NARPM members spend hours learning what is happening legally at the federal, state and local levels. The truly dedicated ones even take it one step further and earn special designations. These designations require a greater investment in time, more specialized training, and giving back to their community of property managers by way of service. The other things that you need to look at when selecting a property manager for your investment would be:

Price – While important, this should not be your primary consideration. In the Denver or Aurora area, most, if not all companies charge a percentage. The most common are between 8% and 15% of the collected monthly rent. Depending on how much time they spend on your property, it usually works out to about $4-$8 an hour. Some also charge a flat fee that is due every month; this is something the Legacy Properties-PM does not do. The other cost is the leasing fee, in other words, the fee charged for the handling all of the prospective tenant contacts, showings, application reviews and lease writing. This is also usually a percentage-based fee and there is a wide range out there of what is charged. You need to talk to any company that you are considering about what you are getting for your money, and see if you can get references.

Experience – This is probably the most important thing for you to look into. Not only how long have they been managing homes, but also what experience do they have that ties in with it. Some examples would be: do they own any rental properties themselves, have they done any hands on cleaning or repairs of rentals, have they personally done any evictions. The staff at Legacy Properties-PM has done everything from cleaning and repairs to being a part of the physical eviction team and everything in between.

Fees – I actually think that this is far more important the price, because this is where your dollars can really add up. You need to know what items your property management company will be charging you for. The most common one is a renewal fee, this is charged for the time spent in discussions with you and the tenant and getting the proper paperwork filled out. Other questions to ask would be: Do they add anything to your repair bills, or charge for property reviews? I’ve even heard on some companies that charge a “paper-processing fee”. What that means is that they add a charge on to every piece of paper or email that they come in contact with for your property. Do they charge a service fee for your evictions, or insurance claims?

Maybe they charge an advertising fee or an account setup fee. These are all things that you need to find out and decide for yourself if they are worth it. With Legacy Properties-PM, you’ll only have three fees. The leasing fee, the management fee and the renewal fee, that’s it.

One other thing you might want to ask them about is how they handle calls that come in after hours and if they will show your property during evenings and weekends. These are very important in keeping your property in good repair and getting it rented quickly.

Once you have done all of your research and compared all of the companies, it’s time to narrow it down to the best two or three companies for your needs. Now comes the hard part, you need to contact those companies again and have a one on one conversation with the person who will be managing your property. Talk to them about your goals and expectations, they may be right on track with you, or maybe not. Either way, you will have a good idea if your personalities match or not. Remember, this is likely to be a person that you will be having a business relationship with for years to come. So, if it seems strained, or they don’t feel genuine to you, then you probably want to keep looking.

Call 720.989.1996 or contact us Legacy Properties-PM; the best in property management in Denver, Aurora, Centennial, and more.